9 Simple Techniques For Property By Helander Llc

Table of ContentsProperty By Helander Llc Can Be Fun For EveryoneProperty By Helander Llc for DummiesGetting The Property By Helander Llc To WorkSome Known Factual Statements About Property By Helander Llc Property By Helander Llc Fundamentals ExplainedThe Facts About Property By Helander Llc Uncovered

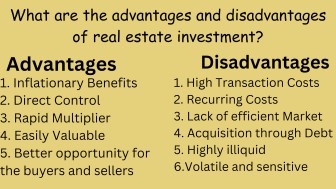

The advantages of investing in realty are numerous. With appropriate properties, investors can enjoy predictable capital, outstanding returns, tax advantages, and diversificationand it's feasible to take advantage of actual estate to develop wide range. Considering purchasing property? Here's what you require to recognize concerning realty benefits and why realty is taken into consideration a good investment.The advantages of buying property include easy earnings, secure capital, tax advantages, diversification, and utilize. Actual estate financial investment trusts (REITs) provide a way to invest in actual estate without needing to have, operate, or financing buildings - https://medium.com/@frederickriley83864/about. Money circulation is the earnings from a realty financial investment after home mortgage payments and general expenses have been made.

In lots of situations, money circulation just enhances gradually as you pay down your mortgageand develop your equity. Real estate capitalists can make use of countless tax obligation breaks and deductions that can conserve cash at tax time. As a whole, you can subtract the practical prices of owning, operating, and taking care of a residential or commercial property.

Fascination About Property By Helander Llc

Realty worths have a tendency to increase over time, and with a good financial investment, you can turn a revenue when it's time to market. Leas also have a tendency to climb with time, which can result in greater capital. This chart from the Federal Reserve Financial Institution of St. Louis reveals typical home rates in the united state

The areas shaded in grey show united state economic crises. Typical Sales Cost of Homes Cost the United States. As you pay for a property mortgage, you develop equityan asset that belongs to your total assets. And as you construct equity, you have the utilize to purchase even more residential properties and boost capital and wealth much more.

Due to the fact that realty is a tangible possession and one that can work as security, financing is easily offered. Actual estate returns differ, relying on variables such as area, property course, and management. Still, a number that many investors intend for is to defeat the typical returns of the S&P 500what many individuals refer to when they claim, "the market." The rising cost of living hedging capability of realty comes from the positive connection in between GDP development and the need genuine estate.

The Property By Helander Llc PDFs

This, in turn, converts into higher resources worths. Real estate often tends to preserve the buying power of resources by passing some of the inflationary stress on to renters and by integrating some of the inflationary pressure in the type of capital appreciation - sandpoint idaho realtor.

Indirect actual estate investing includes no straight possession of a home or properties. Rather, you invest in a swimming pool together with others, where an administration business possesses and runs residential properties, or else has a portfolio of home mortgages. There are numerous means that having property can secure against inflation. Initially, building worths may climb higher than the price of inflation, bring about resources gains.

Lastly, residential or commercial properties funded with a my review here fixed-rate lending will certainly see the family member amount of the month-to-month home loan repayments tip over time-- for circumstances $1,000 a month as a set settlement will end up being less difficult as rising cost of living deteriorates the buying power of that $1,000. Often, a primary residence is ruled out to be a realty financial investment since it is made use of as one's home

The Main Principles Of Property By Helander Llc

Despite the aid of a broker, it can take a couple of weeks of job just to discover the appropriate counterparty. Still, realty is a distinct property course that's easy to comprehend and can improve the risk-and-return account of an investor's portfolio. By itself, realty uses capital, tax breaks, equity building, competitive risk-adjusted returns, and a bush versus rising cost of living.

Buying property can be an extremely gratifying and financially rewarding undertaking, but if you're like a great deal of new investors, you may be questioning WHY you need to be buying property and what benefits it brings over various other investment chances. Along with all the fantastic benefits that come with buying property, there are some disadvantages you need to think about also.

Some Known Factual Statements About Property By Helander Llc

At BuyProperly, we utilize a fractional ownership version that enables investors to begin with as little as $2500. An additional significant advantage of genuine estate investing is the capability to make a high return from buying, renovating, and marketing (a.k.a.

Most flippers many for undervalued buildings in structures neighborhoodsExcellent The terrific thing concerning spending in real estate is that the worth of the property is expected to value.

3 Easy Facts About Property By Helander Llc Described

If you are billing $2,000 rent per month and you incurred $1,500 in tax-deductible costs per month, you will just be paying tax obligation on that $500 profit per month (realtors sandpoint idaho). That's a huge difference from paying tax obligations on $2,000 each month. The earnings that you make on your rental for the year is thought about rental revenue and will be tired accordingly